We here at Options Medical Center are constantly asked why the prices of medical flower are different than recreational, even for the same strain. We understand this can be confusing for the average customer, and we are here to help.

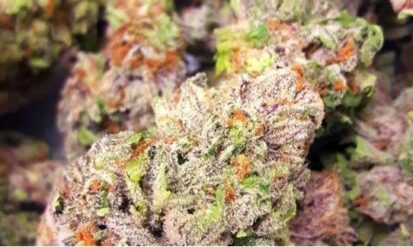

Flower Pricing

The main difference between recreational and MMJ pricing is due to taxes. In addition to standard state and local taxes that are applied to both medical and recreational cannabis products, there is a 15% Colorado Retail MJ tax is applied to only recreational product. Also, when any recreational product is transferred, whether it be from grow to lab or grow to store, it is taxed at a rate of 15% called an excise tax. This extra cost that is not applied to medical marijuana makes the production cost of recreational flower significantly higher. However, this excise tax is only applied the first time a batch of flower is transferred. The cost per pound that the 15% excise tax is applied to is established by the Marijuana Enforcement Division every six months in a calculated AMR (average market rate). There is an AMR for flower, trim, clones, and even seeds that all recreational companies must pay when moving product. This is a lot of information for the average customer to keep up with, especially because so much of it is ever changing, so we are always here to answer your questions! Check out our prices right on our website for both recreational and medicinal (MMJ) flower.